On Monday, Finance Minister Chrystia Freeland announced significant changes to Canada’s mortgage rules aimed at addressing the country’s housing affordability crisis. The most notable adjustments include increasing the cap on insured mortgages to $1.5 million from $1 million and extending the amortization period to 30 years for first-time buyers and new builds. While these changes are intended to help more Canadians enter the housing market, experts remain divided on whether these measures will have a lasting impact.

What’s Changing?

- Higher Cap for Insured Mortgages: Starting December 15, 2024, the government will increase the limit on insured mortgages to $1.5 million. Previously, insured mortgages were only available for homes priced at $1 million or less. This change allows buyers to purchase more expensive homes with a down payment below 20%, with a minimum of 5%, opening the door for more Canadians to enter the market.

- 30-Year Mortgage Amortization: In addition to the higher cap, first-time buyers and those purchasing new homes will now be able to take out a mortgage with a 30-year amortization period. This offers more flexibility in structuring mortgages, potentially lowering monthly payments and making homeownership more feasible in the short term.

Freeland emphasized that these measures are intended to make the dream of homeownership “reachable for more young Canadians” and to incentivize new housing construction, addressing the ongoing housing shortage in Canada.

A Double-Edged Sword?

Reactions to these changes have been mixed. On one hand, expanding the criteria for insured mortgages and allowing 30-year amortizations could improve first-time buyers’ access to the market.

However, there’s a caveat. While these changes could help buyers get into the market, they could also fuel demand, driving up home prices further.

Will These Changes Address the Root Issues?

One of the major challenges in the Canadian housing market is rising interest rates, which have driven mortgage costs higher, compounding the affordability crisis. Unlike in the U.S., where homeowners can lock in their mortgage rate for 15 or 30 years, most Canadian mortgages are structured to reset every three or five years, exposing homeowners to market fluctuations. This structure has left many vulnerable as rates continue to rise, and some experts remain skeptical that the new rules will provide long-term relief.

Additionally, critics argue that while these changes may help some buyers in the short term, they do little to address the fundamental issue: there simply isn’t enough housing supply to meet demand. Without a significant increase in the construction of affordable housing, these measures may end up pushing prices higher rather than making homes more affordable.

The Political Context

The changes to Canada’s mortgage rules come at a time when Prime Minister Justin Trudeau’s Liberal government is facing mounting political pressure, especially with approval ratings dipping to around 30%. NDP Leader Jagmeet Singh recently announced the termination of the supply-and-confidence agreement his party made with Trudeau’s government, an arrangement that had ensured the minority Liberal government’s survival since March 2022. Singh accused the Liberals of consistently giving in to corporate interests, and the NDP is now preparing for the next election by distancing themselves from the unpopular Liberals.

This decision puts the Liberals in a more vulnerable position as they attempt to navigate both rising living costs and growing political uncertainty. As Trudeau’s approval ratings continue to fall, housing affordability has become a major issue for voters. The recent mortgage rule changes, while intended to ease the burden on potential homebuyers, must be viewed within the broader political landscape where both the NDP and Conservatives are positioning themselves as alternatives to the Liberal government’s approach, where the NDP frame the Liberals as having allegiance to corporate Canada and the Conservatives frame them as having exacerbated inflation with excessive spending. This evolving political dynamic will shape the future of housing and economic policy in Canada, and with Parliament back in session, we will continue to monitor the minority parliament situation as it unfolds in anticipation of an election.

My Concluding Thoughts

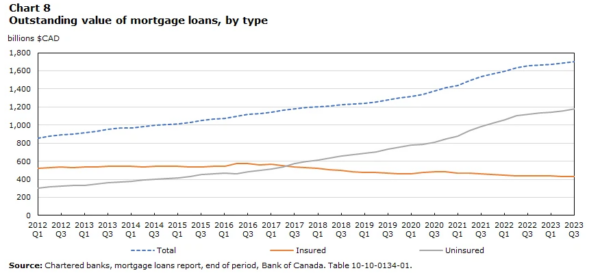

While the increased cap on insured mortgages and the option for a 30-year amortization provide some relief, the broader impact remains uncertain. These changes may help middle-class families looking to access single-family homes, but they do little to address the accessibility of starter homes. The increase in the insured mortgage cap to $1.5 million, for instance, is a tacit admission that home prices have spiraled so far out of control that we now need to effectively subsidize homeownership so more people can qualify for larger mortgages. The impetus for this rule change is the massive spike in uninsured mortgages since 2017. Perhaps this policy could be more effective if they applied it to specific CMAs so it doesn’t incentivize more highly priced development in more reasonably priced parts of the country.

Additionally, extending mortgage terms to 30 years does not challenge the high cost of homes. In fact, longer amortizations could increase demand for more expensive properties, potentially driving prices even higher. The policy does not tackle the root causes of the housing crisis, and it risks inflating prices in the long run.

What Canada really needs is a radical rethinking of its housing supply. We must shift away from prioritizing single-family homes and focus on increasing the availability of more diverse and affordable housing options. Without addressing the underlying supply issues, these mortgage rule changes may simply deepen the challenges that have made homeownership out of reach for many Canadians.

If we are going to explore demand-side policies, we must address the widespread speculative activities not only from foreign investors but also from domestic “mom-and-pop” landlords. Many Canadians use home equity lines of credit (HELOCs) to purchase additional investment properties and engage in purely speculative activities like buying and flipping homes. In Budget 2024, the Government of Canada also announced investigation into mortgage fraud, which artificially inflates demand, with virtually no update since April. We need to demonstrate that we’ve learned from the mistakes of the pre-2022 housing market (before the interest rate hikes). As interest rates eventually decline, there is a real risk of returning to an out-of-control speculative market if we look to purely boost demand as our answer to “affordability”.

Although investors do technically contribute to the rental stock, their overwhelming presence has skewed the housing market, especially in Toronto’s condo sector. Developers have been incentivized to focus on building studio and one-bedroom “shoebox” units, rather than more practical starter homes like two-bedroom apartments or larger. This has created a housing imbalance, and what we truly need is a diverse mix of housing options. This mortgage policy reads as an attempt to resuscitate a flailing condo market. The extension of 30-year amortization for new builds, in particular, will help to reduce condo inventory and improve the pre-construction market, but one should be wary of any framing that this is about “affordability”. Ultimately, this isn’t an affordability play, but instead a play to ensure the real estate market chugs along and people are still buying homes.

We should incentivize developers to build purpose-built rentals and missing-middle housing like duplexes and triplexes. Encouraging the development of Additional Dwelling Units (ADUs), expanding cooperative housing, and promoting community land trusts (CLTs) that remove housing from speculation ensures truly affordable and sustainable housing solutions. Without these shifts in both supply and demand strategies, we risk perpetuating the very problems that have made housing so unattainable for many Canadians, particularly in my generation and younger.

This is exactly the impetus for our Brampton in Motion Symposium on September 26th which will bring together stakeholders, decision makers, and experts to hash out solution to the housing crisis. The topic of demand vs supply side solutions will certainly be discussed. Register here to be part of the conversation.

Do you think relaxing mortgage rules will make housing more accessible? Or will it push prices higher? Have you been priced out of the market? I’d love to hear your thoughts at vsingh@bramptonbot.com.